*/

There is always going to be a place for cash in your short- and medium-term saving plans, but if you intend to save over the long term (typically 5+ years) then choosing to invest could be the best way to shield your money from inflation’s damaging effects and make your savings work as hard as possible.

Investment markets suffer almost cyclical disruptions which, understandably, can act as a deterrent. However, experiencing volatility is an inevitable part of an investment journey and by adopting certain investment principles you can manage risk, foster confidence and get the best chance of achieving your goals.

To create a balanced investment portfolio, it is important to use a blend of investment styles:

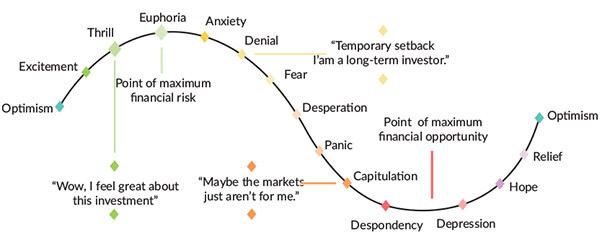

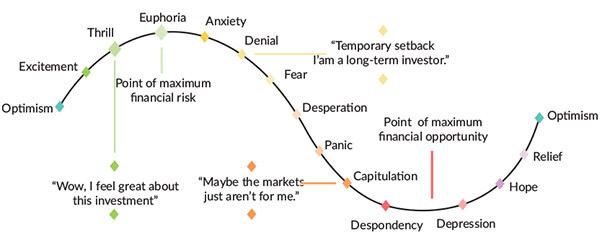

When markets are moving quickly, rash decisions driven by emotion rather than logic can threaten your financial health. It is essential during times of market volatility to retain a long-term perspective and not to make impulsive or irrational decisions.

The future is uncertain and diversification is our best protection against this. Having a number of different funds, each with a different focus, whether in terms of industry/sector or geographical/asset class allocation, can provide smoother and more consistent returns, avoid the risk of missing potential performance from assets you might otherwise not own and spread exposure across correlated and uncorrelated assets. Moreover, thinking we can make accurate predictions leads to less diversification, more risk and, almost inevitably, worse long-term outcomes. It is a relatively simple concept – not keeping all your eggs in one basket – yet can be difficult to do well.

There are thousands of stocks to pick from in the UK alone, so creating an investment portfolio with the best potential for growth, minimal volatility and at a risk level that suits you, is no easy task.

At Westgate, we take a team approach. Our advisers will help you craft a bespoke financial plan and we will work with you to keep this on track – amid all the investment noise. Our consulting fund managers make the stock-picking decisions and our expert investment management team is responsible for selecting, monitoring and changing (as necessary) the global fund managers.

So, ask yourself, do you:

If not, now is the time to review your plans. For a no obligation financial health check, contact Westgate today:

The value of an investment with St. James's Place will be directly linked to the performance of the funds you select and the value can therefore go down as well as up. You may get back less than you invested.

There is always going to be a place for cash in your short- and medium-term saving plans, but if you intend to save over the long term (typically 5+ years) then choosing to invest could be the best way to shield your money from inflation’s damaging effects and make your savings work as hard as possible.

Investment markets suffer almost cyclical disruptions which, understandably, can act as a deterrent. However, experiencing volatility is an inevitable part of an investment journey and by adopting certain investment principles you can manage risk, foster confidence and get the best chance of achieving your goals.

To create a balanced investment portfolio, it is important to use a blend of investment styles:

When markets are moving quickly, rash decisions driven by emotion rather than logic can threaten your financial health. It is essential during times of market volatility to retain a long-term perspective and not to make impulsive or irrational decisions.

The future is uncertain and diversification is our best protection against this. Having a number of different funds, each with a different focus, whether in terms of industry/sector or geographical/asset class allocation, can provide smoother and more consistent returns, avoid the risk of missing potential performance from assets you might otherwise not own and spread exposure across correlated and uncorrelated assets. Moreover, thinking we can make accurate predictions leads to less diversification, more risk and, almost inevitably, worse long-term outcomes. It is a relatively simple concept – not keeping all your eggs in one basket – yet can be difficult to do well.

There are thousands of stocks to pick from in the UK alone, so creating an investment portfolio with the best potential for growth, minimal volatility and at a risk level that suits you, is no easy task.

At Westgate, we take a team approach. Our advisers will help you craft a bespoke financial plan and we will work with you to keep this on track – amid all the investment noise. Our consulting fund managers make the stock-picking decisions and our expert investment management team is responsible for selecting, monitoring and changing (as necessary) the global fund managers.

So, ask yourself, do you:

If not, now is the time to review your plans. For a no obligation financial health check, contact Westgate today:

The value of an investment with St. James's Place will be directly linked to the performance of the funds you select and the value can therefore go down as well as up. You may get back less than you invested.

Now is the time to tackle inappropriate behaviour at the Bar as well as extend our reach and collaboration with organisations and individuals at home and abroad

A comparison – Dan Monaghan, Head of DWF Chambers, invites two viewpoints

And if not, why not? asks Louise Crush of Westgate Wealth Management

Marie Law, Head of Toxicology at AlphaBiolabs, discusses the many benefits of oral fluid drug testing for child welfare and protection matters

To mark International Women’s Day, Louise Crush of Westgate Wealth Management looks at how financial planning can help bridge the gap

Casey Randall of AlphaBiolabs answers some of the most common questions regarding relationship DNA testing for court

Maria Scotland and Niamh Wilkie report from the Bar Council’s 2024 visit to the United Arab Emirates exploring practice development opportunities for the England and Wales family Bar

Marking Neurodiversity Week 2025, an anonymous barrister shares the revelations and emotions from a mid-career diagnosis with a view to encouraging others to find out more

David Wurtzel analyses the outcome of the 2024 silk competition and how it compares with previous years, revealing some striking trends and home truths for the profession

Save for some high-flyers and those who can become commercial arbitrators, it is generally a question of all or nothing but that does not mean moving from hero to zero, says Andrew Hillier