*/

It’s the time of the year when you can review your taxable income for the year ending 5 April 2022 and look at whether to make, or add to, a pension contribution.

The key benefits of a pension are: tax-relief on contributions made at the marginal rate of the contributor (subject to limits); tax-free growth on assets held within a pension; ability to extract 25% of assets saved within a pension tax-free at retirement; exemption from an individual’s estate for inheritance tax purposes; flexibility when drawing income in retirement; and death benefits provide a tax-efficient method to pass on wealth to the next generation.

Be mindful of the key allowances when contributing into a pension. While pensions offer beneficial tax breaks, breaching these allowances can incur penal tax charges and taking formal advice in this area can add significant value.

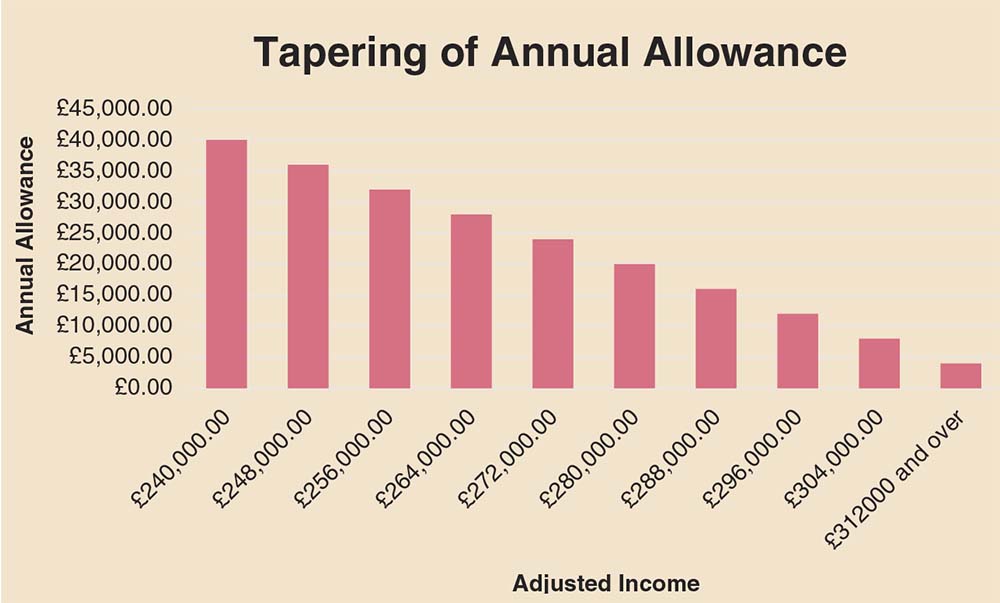

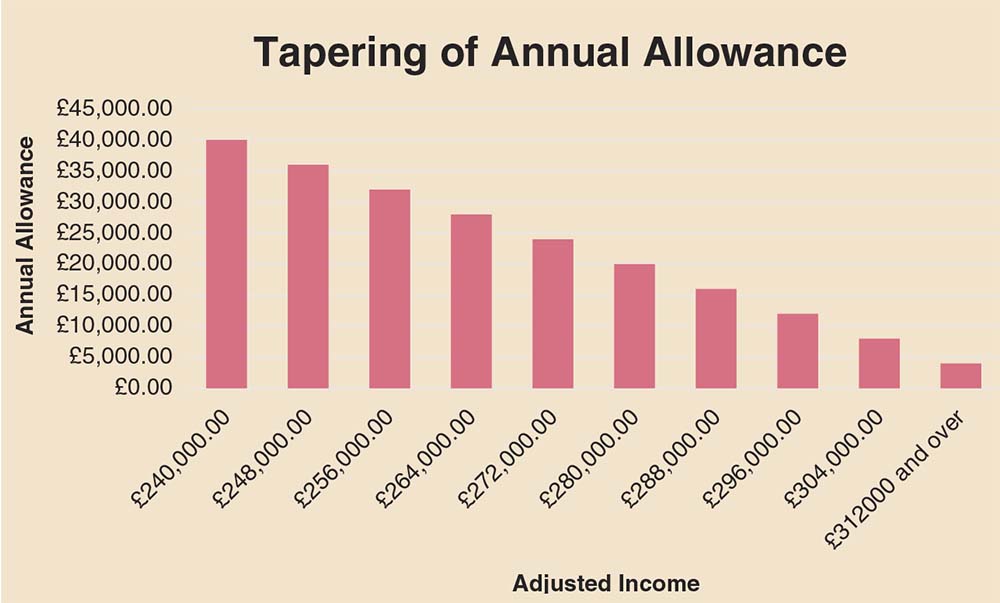

The annual allowance is a cap on the level of gross contributions that can be made into a pension each year. The allowance presently stands at £40,000* and no tax relief is provided on contributions above this, plus additional tax charges may apply. High earners’ annual allowance can be ‘tapered’ down, subject to certain criteria:

Individuals with adjusted income over £240,000 in a tax year will have their annual allowance reduced for that year, by £1 for every £2 earned over £240,000. Income is therefore tapered until the minimum annual allowance of £4,000 is reached (adjusted income of £312,000 or higher). Therefore, any sole trader with adjusted income of £312,000 and over is limited to making a maximum contribution of £4,000 per year into their pension!

However, if your threshold income is £200,000 or less, then you will not be affected by tapering, irrespective of your adjusted income figure. So, by making a personal contribution into a pension plan, you may be able to reduce your threshold income to below £200,000, so that you are not affected by tapering. Note that the tax relief at the marginal rate can be claimed on gross person pension contributions on the higher of £3,600 or 100% of the relevant earnings in a tax year.

The chart (see above), shows the impact of tapering reducing the pension contribution annual allowance. Individuals who are subject to tapering can still carry forward unused relief from previous years, to increase the amount of relievable pension contribution that can be made. Equally, you can carry forward unused relief from a ‘tapering year’, but only the balance of your tapered amount.

While the annual allowance is currently £40,000, if you have been a member of a pension scheme and this allowance has been fully utilised in the three preceding tax years (2018/19 onwards) the unused allowance can be ‘carried forward’ and added to this year’s allowance (providing the individual has relevant earnings to cover a personal contribution of this amount).

This can be a complex area, so here is a worked example: In the tax year 2021/22, a sole trader wishes to pay in a large single gross contribution of £50,000 into their pension plan. They have made monthly gross contributions of £340 being paid on the 1st of each month since the beginning of 2017/18. They have also paid in a gross lump sum of £50,000 in the tax years 2018/19 and 2020/21. The total pension input amount for 2021/22 would be £54,080 (the £50,000 single gross contribution plus £4,080 in respect of the regular monthly gross contributions). As can be seen in the table (above) they will have more than enough annual allowance to cover this due to the carry forward of £21,840.

A key benefit of saving into a pension is the tax relief which is provided by HMRC. However, it is important to ensure that the tax relief is not forgotten when considering contribution limits. Your net pension contribution (the amount which you contribute yourself) is ‘grossed-up’ by a 20% top-up that is claimed from HMRC by your pension scheme. This claim from your pension scheme is often forgotten when paying into your pension. So, an individual wanting to make a gross pension contribution of £40,000 would only physically pay a £32,000 net contribution into their pension scheme. If you are a higher/additional rate taxpayer, the additional relief is claimed back via self-assessment.

If you are not aware of the difference between the gross and net limits and, for example, paid a £40,000 net contribution into the scheme, this would be grossed up to £50,000 meaning it was now £10,000 over the limit. There would therefore be a resulting additional tax charge of £2,000 if a basic rate taxpayer (20% of £10,000), £4,000 if a higher rate tax payer (40% of £10,000) or £4,500 if an additional rate tax payer (45% of £10,000).

Any unused pension allowances from the last three tax years (from 5 April 2019 to 5 April 2022), can be carried forward and offset against any excess amount.

Once an individual has reached the lifetime allowance (LTA) – a limit on the amount you can save into a pension (£1,073,100 in the 2021/22 tax year) tax charges on the excess apply. These charges are either incurred when the balance above the LTA is drawn as income/a lump sum, upon reaching the age of 75, or upon death, whichever is sooner. Advice should be sought in this area as individual circumstances will dictate the most appropriate course of action – this can be a highly complex area as a combination of income tax/lifetime allowance charges and inheritance tax can apply depending on the route taken. As mentioned in previous articles, one consideration is to incorporate and keep surplus funds to pay out of the company (as dividends) post retirement as opposed to paying them into a pension scheme. These surplus funds can often be invested by the company in much the same way a pension scheme would invest for the future.

The use of pensions provides a tax-efficient means to extract profits from a business. Employer pension contributions are made gross of tax and national insurance, while also being offsetable against corporation tax as an allowable expense. (Note that contributions are not grossed up when paid by an employer.) This allows profit extraction into an environment in which investments can grow free of tax until retirement – maximising tax efficiency and allowing individuals to build personal wealth outside of their business.

The key point to remember here is that the company can still contribute £40,000 into your pension scheme every year regardless of how much you withdraw from the company through salary and/or dividends. This is subject to meeting the ‘wholly and exclusively’ criteria in line with HMRC rules.

* You are limited to contributing £40,000 or the equivalent of your gross earnings each tax year, whichever is lower.

This article contains some of the important considerations, but every individual’s personal circumstances are different and there might be further considerations not mentioned in this article. Therefore, it is important to seek professional advice from a financial adviser if you are looking to make pension contributions. This article is provided without any acceptance by RWB CA Ltd, RWB Wealth Management Ltd, or any of their staff, of any responsibility whatsoever and any use you wish to make of the information is therefore entirely at your own risk.

It’s the time of the year when you can review your taxable income for the year ending 5 April 2022 and look at whether to make, or add to, a pension contribution.

The key benefits of a pension are: tax-relief on contributions made at the marginal rate of the contributor (subject to limits); tax-free growth on assets held within a pension; ability to extract 25% of assets saved within a pension tax-free at retirement; exemption from an individual’s estate for inheritance tax purposes; flexibility when drawing income in retirement; and death benefits provide a tax-efficient method to pass on wealth to the next generation.

Be mindful of the key allowances when contributing into a pension. While pensions offer beneficial tax breaks, breaching these allowances can incur penal tax charges and taking formal advice in this area can add significant value.

The annual allowance is a cap on the level of gross contributions that can be made into a pension each year. The allowance presently stands at £40,000* and no tax relief is provided on contributions above this, plus additional tax charges may apply. High earners’ annual allowance can be ‘tapered’ down, subject to certain criteria:

Individuals with adjusted income over £240,000 in a tax year will have their annual allowance reduced for that year, by £1 for every £2 earned over £240,000. Income is therefore tapered until the minimum annual allowance of £4,000 is reached (adjusted income of £312,000 or higher). Therefore, any sole trader with adjusted income of £312,000 and over is limited to making a maximum contribution of £4,000 per year into their pension!

However, if your threshold income is £200,000 or less, then you will not be affected by tapering, irrespective of your adjusted income figure. So, by making a personal contribution into a pension plan, you may be able to reduce your threshold income to below £200,000, so that you are not affected by tapering. Note that the tax relief at the marginal rate can be claimed on gross person pension contributions on the higher of £3,600 or 100% of the relevant earnings in a tax year.

The chart (see above), shows the impact of tapering reducing the pension contribution annual allowance. Individuals who are subject to tapering can still carry forward unused relief from previous years, to increase the amount of relievable pension contribution that can be made. Equally, you can carry forward unused relief from a ‘tapering year’, but only the balance of your tapered amount.

While the annual allowance is currently £40,000, if you have been a member of a pension scheme and this allowance has been fully utilised in the three preceding tax years (2018/19 onwards) the unused allowance can be ‘carried forward’ and added to this year’s allowance (providing the individual has relevant earnings to cover a personal contribution of this amount).

This can be a complex area, so here is a worked example: In the tax year 2021/22, a sole trader wishes to pay in a large single gross contribution of £50,000 into their pension plan. They have made monthly gross contributions of £340 being paid on the 1st of each month since the beginning of 2017/18. They have also paid in a gross lump sum of £50,000 in the tax years 2018/19 and 2020/21. The total pension input amount for 2021/22 would be £54,080 (the £50,000 single gross contribution plus £4,080 in respect of the regular monthly gross contributions). As can be seen in the table (above) they will have more than enough annual allowance to cover this due to the carry forward of £21,840.

A key benefit of saving into a pension is the tax relief which is provided by HMRC. However, it is important to ensure that the tax relief is not forgotten when considering contribution limits. Your net pension contribution (the amount which you contribute yourself) is ‘grossed-up’ by a 20% top-up that is claimed from HMRC by your pension scheme. This claim from your pension scheme is often forgotten when paying into your pension. So, an individual wanting to make a gross pension contribution of £40,000 would only physically pay a £32,000 net contribution into their pension scheme. If you are a higher/additional rate taxpayer, the additional relief is claimed back via self-assessment.

If you are not aware of the difference between the gross and net limits and, for example, paid a £40,000 net contribution into the scheme, this would be grossed up to £50,000 meaning it was now £10,000 over the limit. There would therefore be a resulting additional tax charge of £2,000 if a basic rate taxpayer (20% of £10,000), £4,000 if a higher rate tax payer (40% of £10,000) or £4,500 if an additional rate tax payer (45% of £10,000).

Any unused pension allowances from the last three tax years (from 5 April 2019 to 5 April 2022), can be carried forward and offset against any excess amount.

Once an individual has reached the lifetime allowance (LTA) – a limit on the amount you can save into a pension (£1,073,100 in the 2021/22 tax year) tax charges on the excess apply. These charges are either incurred when the balance above the LTA is drawn as income/a lump sum, upon reaching the age of 75, or upon death, whichever is sooner. Advice should be sought in this area as individual circumstances will dictate the most appropriate course of action – this can be a highly complex area as a combination of income tax/lifetime allowance charges and inheritance tax can apply depending on the route taken. As mentioned in previous articles, one consideration is to incorporate and keep surplus funds to pay out of the company (as dividends) post retirement as opposed to paying them into a pension scheme. These surplus funds can often be invested by the company in much the same way a pension scheme would invest for the future.

The use of pensions provides a tax-efficient means to extract profits from a business. Employer pension contributions are made gross of tax and national insurance, while also being offsetable against corporation tax as an allowable expense. (Note that contributions are not grossed up when paid by an employer.) This allows profit extraction into an environment in which investments can grow free of tax until retirement – maximising tax efficiency and allowing individuals to build personal wealth outside of their business.

The key point to remember here is that the company can still contribute £40,000 into your pension scheme every year regardless of how much you withdraw from the company through salary and/or dividends. This is subject to meeting the ‘wholly and exclusively’ criteria in line with HMRC rules.

* You are limited to contributing £40,000 or the equivalent of your gross earnings each tax year, whichever is lower.

This article contains some of the important considerations, but every individual’s personal circumstances are different and there might be further considerations not mentioned in this article. Therefore, it is important to seek professional advice from a financial adviser if you are looking to make pension contributions. This article is provided without any acceptance by RWB CA Ltd, RWB Wealth Management Ltd, or any of their staff, of any responsibility whatsoever and any use you wish to make of the information is therefore entirely at your own risk.

Now is the time to tackle inappropriate behaviour at the Bar as well as extend our reach and collaboration with organisations and individuals at home and abroad

A comparison – Dan Monaghan, Head of DWF Chambers, invites two viewpoints

And if not, why not? asks Louise Crush of Westgate Wealth Management

Marie Law, Head of Toxicology at AlphaBiolabs, discusses the many benefits of oral fluid drug testing for child welfare and protection matters

To mark International Women’s Day, Louise Crush of Westgate Wealth Management looks at how financial planning can help bridge the gap

Casey Randall of AlphaBiolabs answers some of the most common questions regarding relationship DNA testing for court

Maria Scotland and Niamh Wilkie report from the Bar Council’s 2024 visit to the United Arab Emirates exploring practice development opportunities for the England and Wales family Bar

Marking Neurodiversity Week 2025, an anonymous barrister shares the revelations and emotions from a mid-career diagnosis with a view to encouraging others to find out more

David Wurtzel analyses the outcome of the 2024 silk competition and how it compares with previous years, revealing some striking trends and home truths for the profession

Save for some high-flyers and those who can become commercial arbitrators, it is generally a question of all or nothing but that does not mean moving from hero to zero, says Andrew Hillier