*/

By Louise Crush of Westgate Wealth Management sets out the key steps to your dream property

Mortgages can be difficult to navigate at the self-employed Bar, where you experience fluctuating income and aged debt. Alongside this, the mortgage market will be impacted by changes in government and fiscal policies, the regular Bank of England interest rate announcements and moveable inflation rates.

Buying your first home will be one of the biggest financial decisions you make in the early part of your life. Getting the right advice before you set off looking for the right property will help to make sure you don’t go over budget and have everything ready to proceed at the point you want to make an offer, giving you the best chance of having your offer accepted.

Your first mortgage will no doubt have an incentive deal which typically expires after 2 to 5 years. At that point – if you don’t take action – lenders will move you on to their standard variable rate, which can mean a significant increase in your monthly payments. Reviewing this six months before the end of your current deal allows time to get everything lined up for you to switch product or lender to make sure you avoid this jump in your payments by moving to a better deal in the market.

Looking to purchase a home can add a lot of additional administrative work to your schedule, when you are already time poor. It’s not quite as easy as 1, 2, 3; but if you follow our step-by-step guide, it can help you navigate what might otherwise feel an overwhelming task:

Being able to search quickly and efficiently from some of the best deals available in the market isn’t just a case of finding the best rate. Getting professional guidance allows you to benefit from advice around fixed or tracker rates, product terms and mortgage length.

Barristers may also benefit from bespoke underwriting, so lenders will understand how and when you are paid and what you can expect to earn in the coming years. Using an intermediary who knows the right lenders to speak to can help save you money and could make the difference between getting the property you want or not.

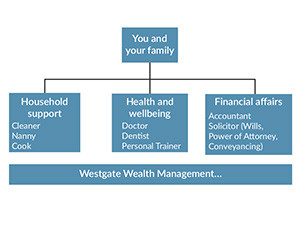

Your personal power team are there to help you make life easy. They are the ‘who’ for your ‘how’ tasks and have your best interests in mind, so you can make the most of an opportunity when it comes along.

Is Westgate on your personal power team? When you are ready to take your next step on the property ladder or review your existing mortgage and protection, book a no-obligation meeting with us, using the details below:

Mortgages can be difficult to navigate at the self-employed Bar, where you experience fluctuating income and aged debt. Alongside this, the mortgage market will be impacted by changes in government and fiscal policies, the regular Bank of England interest rate announcements and moveable inflation rates.

Buying your first home will be one of the biggest financial decisions you make in the early part of your life. Getting the right advice before you set off looking for the right property will help to make sure you don’t go over budget and have everything ready to proceed at the point you want to make an offer, giving you the best chance of having your offer accepted.

Your first mortgage will no doubt have an incentive deal which typically expires after 2 to 5 years. At that point – if you don’t take action – lenders will move you on to their standard variable rate, which can mean a significant increase in your monthly payments. Reviewing this six months before the end of your current deal allows time to get everything lined up for you to switch product or lender to make sure you avoid this jump in your payments by moving to a better deal in the market.

Looking to purchase a home can add a lot of additional administrative work to your schedule, when you are already time poor. It’s not quite as easy as 1, 2, 3; but if you follow our step-by-step guide, it can help you navigate what might otherwise feel an overwhelming task:

Being able to search quickly and efficiently from some of the best deals available in the market isn’t just a case of finding the best rate. Getting professional guidance allows you to benefit from advice around fixed or tracker rates, product terms and mortgage length.

Barristers may also benefit from bespoke underwriting, so lenders will understand how and when you are paid and what you can expect to earn in the coming years. Using an intermediary who knows the right lenders to speak to can help save you money and could make the difference between getting the property you want or not.

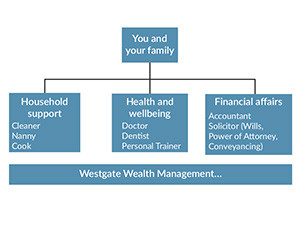

Your personal power team are there to help you make life easy. They are the ‘who’ for your ‘how’ tasks and have your best interests in mind, so you can make the most of an opportunity when it comes along.

Is Westgate on your personal power team? When you are ready to take your next step on the property ladder or review your existing mortgage and protection, book a no-obligation meeting with us, using the details below:

By Louise Crush of Westgate Wealth Management sets out the key steps to your dream property

Now is the time to tackle inappropriate behaviour at the Bar as well as extend our reach and collaboration with organisations and individuals at home and abroad

A comparison – Dan Monaghan, Head of DWF Chambers, invites two viewpoints

And if not, why not? asks Louise Crush of Westgate Wealth Management

Marie Law, Head of Toxicology at AlphaBiolabs, discusses the many benefits of oral fluid drug testing for child welfare and protection matters

To mark International Women’s Day, Louise Crush of Westgate Wealth Management looks at how financial planning can help bridge the gap

Casey Randall of AlphaBiolabs answers some of the most common questions regarding relationship DNA testing for court

Maria Scotland and Niamh Wilkie report from the Bar Council’s 2024 visit to the United Arab Emirates exploring practice development opportunities for the England and Wales family Bar

Marking Neurodiversity Week 2025, an anonymous barrister shares the revelations and emotions from a mid-career diagnosis with a view to encouraging others to find out more

David Wurtzel analyses the outcome of the 2024 silk competition and how it compares with previous years, revealing some striking trends and home truths for the profession

Save for some high-flyers and those who can become commercial arbitrators, it is generally a question of all or nothing but that does not mean moving from hero to zero, says Andrew Hillier